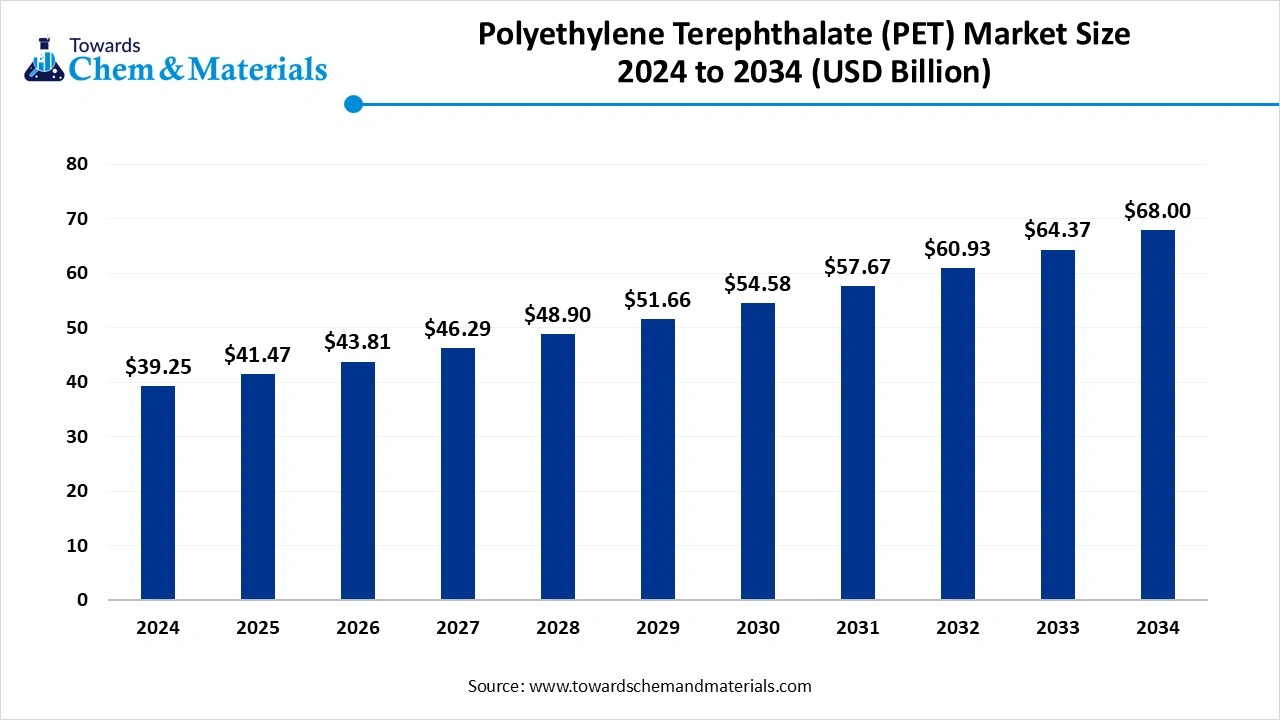

Ottawa, Dec. 01, 2025 (GLOBE NEWSWIRE) -- The global polyethylene terephthalate (PET) market size was valued at USD 41.47 billion in 2025 and is predicted to increase from USD 43. 81 billion in 2026 is anticipated to reach around USD 68.00 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period 2025 to 2034. The growth of the polyethylene terephthalate (PET) market is primarily driven by rising global demand for PET in packaging, particularly for beverages, food containers, and personal care products, due to its lightweight, durable, and recyclable properties. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5697

What is Polyethylene Terephthalate (PET)?

The polyethylene terephthalate (PET) market is experiencing significant growth due to its widespread use in packaging, textiles, and industrial applications. PET's lightweight, durable, and recyclable nature makes it a preferred material for beverage bottles, food containers, and personal care products. The rising global consumption of bottled water, carbonated drinks, and ready-to-drink beverages is driving increased PET resin production. In the textile sector, polyester fibers derived from PET are in high demand for apparel, home furnishings, and industrial uses.

Additionally, growing sustainability concerns and regulatory support for recycled PET (rPET) are encouraging the adoption of eco-friendly production processes. Technological advancements in polymerization and catalyst efficiency further enhance PET quality and production capacity, solidifying its market expansion.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Polyethylene Terephthalate (PET) Market Report Highlights

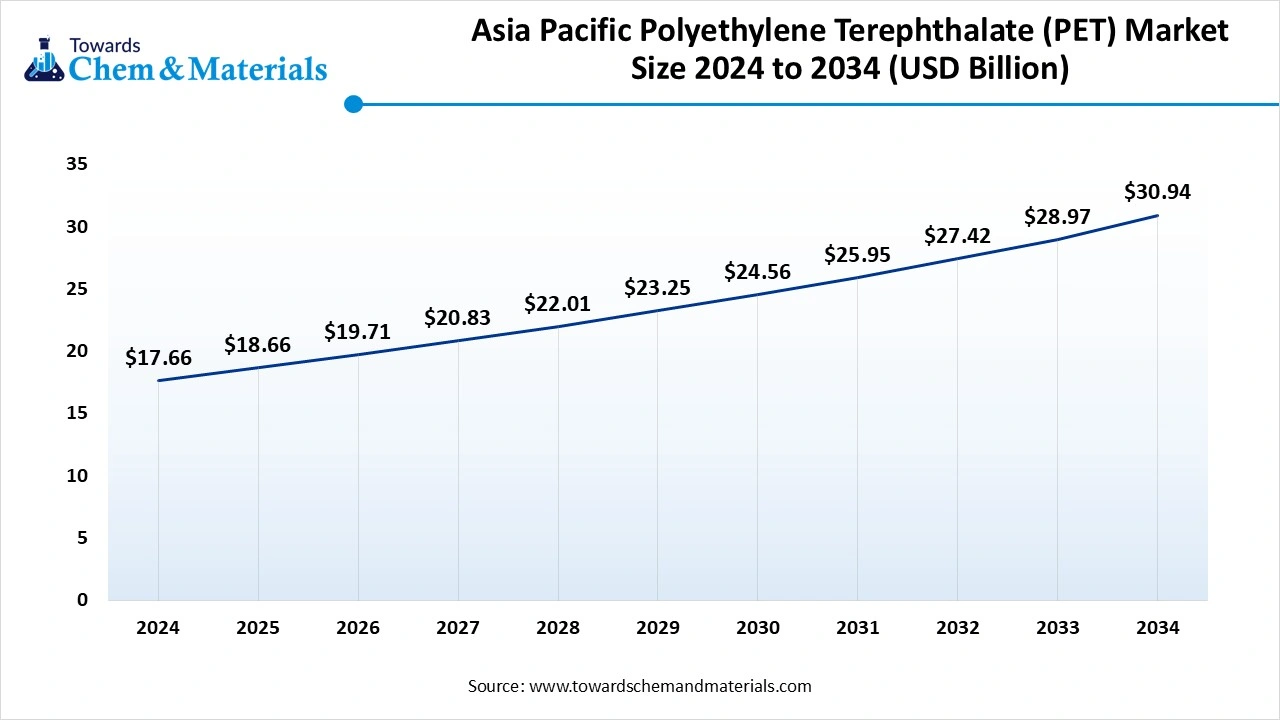

- The Asia Pacific polyethylene terephthalate (PET) market size was estimated at USD 17.66 billion in 2024 and is expected to reach USD 30.94 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034.

- By product type, the virgin PET – PET-bottle-grade segment dominated the market in 2024. The virgin PET–bottle–grade segment held a 45% share in the market in 2024. Transparency and clarity, and thermal properties boost the growth.

- By form, the amorphous pet (APET) segment dominated the market in 2024. The amorphous pet (APET) segment held a 38% share in the market in 2024. Strength and stiffness offered by the product drive the growth.

- By application, the bottles (packaging) segment dominated the market in 2024. The bottles (packaging) segment held a 60% share in the market in 2024. The clarity and strength offered fuel the demand for the market.

- By end use, the food & beverage segment dominated the market in 2024. The food & beverage segment held a 50% share in the market in 2024. The packaging of food and beverage products, due to its barrier properties, drives the growth.

- By processing technology, the blow molding segment dominated the market in 2024. The blow molding segment held a 52% share in the market in 2024. The lightweight property and reduced cost of production fuel the demand for the segment.

- By distribution channel, the direct sale segment dominated the market in 2024. The direct sale segment held a 55% share in the market in 2024. The ease of supply of large volume material drives the demand.

Polyethylene Terephthalate (PET) production in plastics & polymers production

Instrumentation for Temperature- and Pressuresensitive PET Production Processes

Polyethylene terephthalate (PET) is used in the manufacture of blow-moulded plastic bottles (PET bottles) and in films amongst other things and is one of the main synthetic fibres. In order to produce PET, the monomers terephthalic acid and ethylene glycol extracted by petrochemical means are esterified in the reactor at a moderate pressure (2.7–5.5 bar) and high temperature (220–260°C) using a catalyst. In a second stage, gradual pre-polymerisation is performed, whereby separated water and waste products are continuously removed from the reaction mixture, as otherwise the reaction would be inhibited. In parallel to this, reactive intermediate products are returned to the esterification reactor. The final polymerisation stage takes place at up to 280°C and at very low pressure (< 1 mbar). The PET fibres can then be produced from the extracted molten polyester using the melt-spinning method for example.

PET manufacture must not only fulfil food regulatory limit values and taste requirements, but nowadays the plant must also significantly reduce energy consumption and sustainably lower operating costs too. This involves keeping the process variables of flow rate, pressure and temperature within narrow limits, which requires comprehensive monitoring. KROHNE offers the ideal technical measuring systems for this, such as industrial/resistance thermometers for use in piping and tanks. There are also pressure transmitters to simultaneously measure the process pressure and fill level up to +200 °C as well as radar level meters for liquids, pastes and sludges, which are suitable for continuous, non-contact level measurement in storage and process tanks. And 2-wire level transmitters with guided radar come in a wide range of sensors and materials, which means they can even be used in high pressure and temperature conditions.

Immediate Delivery Available | Buy This Premium Research Report@https://www.towardschemandmaterials.com/checkout/5697

Polyethylene Terephthalate Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 43.81 billion |

| Revenue forecast in 2034 | USD 68 billion |

| Growth Rate | CAGR of 5.65% from 2025 to 2034 |

| Base year for estimation | 2025 |

| Historical data | 2018 - 2023 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in kilotons, revenue in USD million and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Form, By Application, By End-Use Industry, By Processing Technology, By Distribution Channel, By Region |

| Regional scope | North America; Asia Pacific; Europe; Latin America; Middle East and Africa |

| Country scope | U.S., Canada, China, India, Japan, Southeast Asia, Germany, France, UK, Spain, Italy, Brazil, and Mexico |

| Key companies profiled | Indorama Ventures; Far Eastern New Century; DAK Americas; Nan Ya Plastics Corporation; SABIC; Dupont; Lotte Chemical Corporation; LAVERGNE, Inc.; Amcor plc; Reliance Industries; Octal Petrochemicals; Jiangsu Sanfangxiang Group Co., Ltd.; Eastman Chemical Company. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Smart Polymers: How AI Is Revolutionizing the PET Industry

AI is transforming the polyethylene terephthalate (PET) industry by enabling predictive process optimization, which improves polymerization efficiency and reduces production defects. Machine learning algorithms analyze real-time data to optimize reaction conditions, enhancing product quality, clarity, and mechanical strength. AI-driven monitoring also helps minimize energy consumption and waste, supporting more sustainable and cost-effective PET manufacturing.

In recycled PET (rPET) production, AI aids in controlling impurities and maintaining consistent polymer properties, ensuring high-quality outputs. Additionally, AI accelerates R&D for advanced catalysts and formulations, shortening development cycles and enabling rapid innovation.

How is PET produced?

Polyethylene terephthalate is an aliphatic polyester. It is obtained from the polycondensation reaction of the monomers obtained either by:

- Esterification reaction between terephthalic acid and ethylene glycol, or

- Trans-esterification reaction between ethylene glycol and dimethyl terephthalate

The reaction produces PET in the form of a molten and viscous mass. This can be directly spun into fibers or extruded or molded into almost any shape. Chemically, Polyethylene terephthalate is very much similar to Polybutylene Terephthalate.

Polyethylene Terephthalate (PET): Types and processing

What is PETG?

PET-G stands for Glycol modified polyethylene terephthalate. It is the copolymer form of polyethylene terephthalate homopolymer.

Features of glycol modification of PET through copolymerization include:

- It improves processability (faster elongation rates and higher elongations).

- It lowers the glass transition and melting temperature of PET.

- It decreases the crystallization temperature and rate.

- It is a polyester with good toughness and chemical resistance.

- It also differentiates the properties of polyethylene terephthalate (PET).

As a technical material, PETG provides good mechanical properties. It also improves chemical and thermal behaviors with similar ease of use. All these comparisons are made with respect to PLA.

The common modifiers which replace ethylene glycol or terephthalic acid to produce PETG are cyclohexane dimethanol (CHDM) and isophthalic acid respectively. These modifiers interfere with crystallization and lower the polymer's melting temperature.

Which is your material of choice - PET vs PVC?

| Feature | Polyethylene Terephthalate (PET) | Polyvinyl Chloride (PVC) |

| Recycling | Easier to recycle; widely accepted in mechanical recycling | Challenging to recycle due to high chlorine content (56%) and high additive use; must be separated from other plastics |

| Durability & strength | Stronger and more durable; UV resistant, shatterproof, lightweight, and resistant to microbial attacks | Rigid but moderately durable; can become hard and break down under sunlight exposure |

| Suitability for packaging | Ideal due to strength, durability, and resistance to natural elements | Not ideal due to potential brittleness and UV sensitivity |

| Cost & raw materials | Contains more oil-based raw materials; price fluctuates with oil; higher scrap value; cheaper long-term | Closely priced to PET initially; lower scrap value; less affected by oil price fluctuations |

Major Private Industry Investments for Polyethylene Terephthalate (PET):

- Indorama Ventures: This global chemical company has invested $150 million to build three new PET recycling plants in India, aiming to expand its capacity and produce recycled PET for the Indian and export markets.

- Far Eastern New Century (FENC): The Taiwanese company received green funding to expand its recycled PET facility in Malaysia, with a goal of producing 50,000 metric tons of rPET per year from post-consumer materials.

- Alpek: In 2022, the Mexican petrochemical company acquired Octal Holding for $620 million, a move designed to integrate Alpek into the high-value PET sheet business segment and advance its sustainability goals.

- Ganesha Ecosphere Ltd.: A leader in India's recycled polyester market, the company specializes in producing recycled polyester staple fiber (RPSF) from PET bottles, supported by government policies encouraging recycled content.

- Lotte Chemical Corporation: This South Korean chemical company has invested in converting existing capacity to produce recycled PET (rPET) at its plants, with test production beginning in 2022.

Polyethylene Terephthalate (PET) Market Trends:

- Surging Demand for Recycled PET (rPET): Driven by increasing environmental awareness and stringent government regulations, there is a global push for the adoption of recycled PET in packaging and textiles. Major brands are making significant pledges to use 50% or more recycled content in their products, creating a robust market for rPET to reduce plastic waste and carbon footprints.

- Advancements in Recycling Technologies: The industry is seeing rapid development in advanced recycling methods, particularly chemical recycling, which can break down mixed or contaminated PET waste into its original monomers. This innovation allows for the creation of virgin-quality, food-grade rPET from previously unrecyclable sources, significantly increasing the potential for a circular economy.

- Diversification of High-Performance Applications: Beyond traditional bottles and packaging, PET's inherent properties (lightweight strength, chemical resistance, thermal stability) are driving its expansion into new sectors. This includes use in advanced textiles for performance apparel, technical films for electronics and solar panels, and engineering plastics for automotive components.

Market Opportunity

The rPET Transformation: PET's Biggest Opportunity in the Circular Economy Expansion

A major opportunity in the polyethylene terephthalate (PET) market lies in the rapidly accelerating demand for high-quality recycled PET (rPET), driven by global sustainability mandates and brand commitments to reduce plastic waste. As beverage, food, and textile manufacturers push for higher recycled content in their products, the need for advanced recycling technologies and superior rPET grades is skyrocketing.

This shift opens the door for innovation in mechanical and chemical recycling processes that can deliver near-virgin-quality PET. Companies that invest in efficient, low-carbon rPET production and closed-loop systems stand to capture significant growth as governments tighten regulations on single-use plastics.

Immediate Delivery Available | Buy This Premium Research Report@https://www.towardschemandmaterials.com/checkout/5697

Polyethylene Terephthalate (PET) Market Segmentation Insights

Product Type Insights

The virgin PET – PET-bottle-grade segment led the market in 2024 because of the consistently high global demand for beverage bottles, especially for bottled water, carbonated drinks, and ready-to-drink products. This grade offers superior clarity, strength, and low acetaldehyde levels, making it the preferred choice for food- and beverage-safe packaging. Manufacturers favored virgin PET bottle grade due to its reliable processing performance and ability to meet stringent regulatory and quality standards across regions.

The recycled PET – clear PET segment is growing fastest over the forecast period due to rising global demand for sustainable and circular packaging solutions. Clear rPET is highly favored by beverage and food brands because it offers excellent transparency and quality comparable to virgin PET, making it ideal for premium packaging. Growing regulatory pressure to incorporate higher recycled content in packaging drove manufacturers to adopt clear rPET at scale.

Form Insights

The amorphous pet (APET) segment led the market in 2024 due to its superior clarity, excellent thermoformability, and high impact resistance, making it ideal for premium packaging applications. APET's suitability for food trays, clamshells, and display packaging boosted its adoption across the food, electronics, and consumer goods industries. Its recyclability and compatibility with recycled PET (rPET) aligned well with global sustainability goals, further driving demand.

The crystalline PET (CPET) segment is growing fastest over the forecast period because its high heat resistance made it ideal for ready-meal trays, ovenable packaging, and other temperature-tolerant food applications. CPET offers superior dimensional stability and rigidity, enabling manufacturers to meet the growing demand for durable and safe food packaging solutions. Its excellent barrier properties also supported longer shelf life, which became increasingly important in processed and convenience food sectors.

Application Insights

The bottles (packaging) segment led the market in 2024 due to the high global demand for bottled water, carbonated drinks, and ready-to-drink beverages that rely heavily on PET's lightweight and durable properties. Manufacturers favored PET bottles for their excellent clarity, strength, and safety, making them ideal for food-grade and on-the-go packaging applications. Increasing sustainability commitments and the rising use of recycled PET (rPET) in bottle production further strengthened this segment's dominance.

The films & sheets segment is the second-largest segment, leading the market due to growing demand for durable, lightweight, and high-clarity packaging materials across food, electronics, and industrial sectors. PET films offer excellent barrier properties, making them ideal for flexible packaging, labeling, and protective applications. The rise of e-commerce and increasing preference for convenient, shelf-stable packaged goods further boosted the need for high-performance PET sheets.

End-use Insights

In 2024, the food & beverage segment led the market due to the massive global demand for bottled water, carbonated drinks, juices, and ready-to-drink products that rely heavily on PET packaging. PET's excellent clarity, lightweight nature, and strong barrier properties make it the preferred material for safe and attractive food and beverage containers. Growing consumer preference for portable, durable, and recyclable packaging further strengthened the segment's dominance.

The healthcare segment is the second-largest segment, leading the market due to rising demand for high-quality, contamination-resistant packaging used in pharmaceuticals, medical devices, and diagnostic products. PET's excellent barrier properties, chemical resistance, and clarity make it the preferred material for sterile packaging and safe medicine storage. Increasing investment in biologics, injectable drugs, and home healthcare solutions further boosted the need for reliable PET-based containers.

Processing Technology Insights

In 2024, the blow molding segment led the market because it remained the most widely used processing technology for producing PET bottles and containers, which dominate global PET consumption. Its ability to create lightweight, durable, and high-clarity packaging made it indispensable for beverages, household chemicals, and personal care products. Blow molding also supports high-speed, large-scale production, helping manufacturers meet rising demand for bottled water, carbonated drinks, and ready-to-drink beverages.

The thermoforming segment is projected for fastest growth in the market because of its growing use in food trays, clamshells, and disposable packaging, driven by rising demand for convenience and ready-to-eat meals. PET's excellent clarity, strength, and barrier properties make it the preferred material for thermoformed products that require high visibility and durability. The segment also benefited from increasing adoption of recycled PET (rPET) sheets, supporting sustainability goals and regulatory compliance.

Distribution Channel Insights

In 2024, the direct sale segment led the market because major PET resin producers increasingly preferred selling directly to large beverage, packaging, and textile manufacturers to ensure consistent supply and pricing stability. Direct sales allowed suppliers to build long-term partnerships with high-volume buyers, improving demand forecasting and production planning. This model also reduced dependency on intermediaries, lowering distribution costs and enhancing profit margins for producers. Additionally, direct engagement enabled faster customization of PET grades to meet specific clarity, strength, and sustainability requirements of key end-use industries.

The online retail segment is the fastest-growing segment in the market as e-commerce platforms experienced rapid growth in demand for PET-packaged products across beverages, personal care, homecare, and food categories. The convenience of doorstep delivery and rising preference for lightweight, shatter-resistant packaging made PET containers ideal for online shipping and logistics. PET's durability reduced product damage during transit, prompting brands to favor it for e-commerce–focused packaging strategies.

Regional Insights

Asia Pacific Leads the Charge: Regional Dominance in the Polyethylene Terephthalate (PET) Market

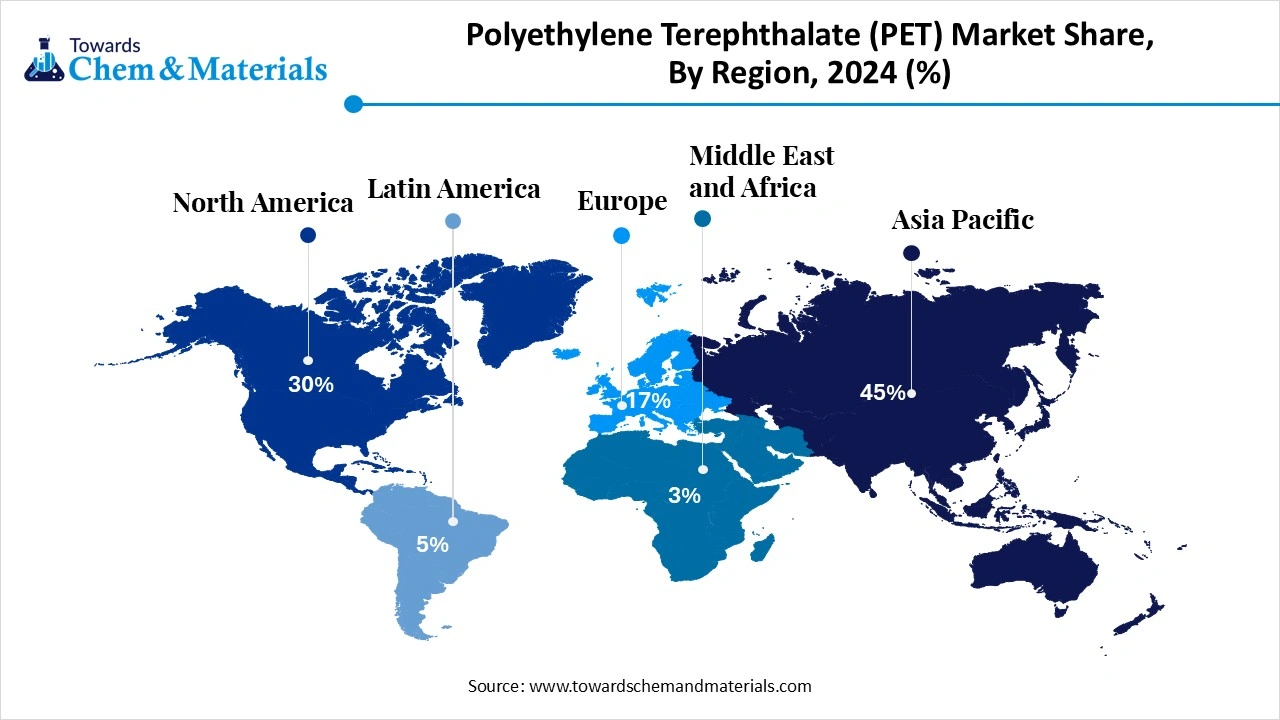

The Asia Pacific polyethylene terephthalate (PET) market size was estimated at USD 17.66 billion in 2024 and is anticipated to reach USD 30.94 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034. the Asia Pacific has accounted highest revenue share of around 45% in 2024.

Asia-Pacific dominated the market in 2024 largely due to its massive packaging, textile, and consumer goods industries, which generate strong and consistent demand for PET resins. The region's rapid urbanization and rising consumption of bottled water, ready-to-drink beverages, and packaged foods have significantly boosted PET bottle- and film-grade production. China, India, and Southeast Asian countries continue to expand large-scale PET manufacturing capacities, supported by competitive production costs and robust export networks.

China Polyethylene Terephthalate Market Trends

The polyethylene terephthalate market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its rapid industrial growth and urbanization. As one of the largest consumers of PET globally, China’s expanding packaging, automotive, and electronics sectors are major drivers of demand. In addition, the country’s focus on environmental sustainability has led to increased investments in recycling technologies, enhancing PET's appeal as a recyclable material. Furthermore, the rise in health-conscious consumers is boosting the demand for bottled beverages and packaged foods, further propelling the growth of the PET market in China.

India Polyethylene Terephthalate (PET) Market Trends

India’s market is experiencing strong growth driven by increasing demand from the beverage, packaged food, and textile industries. Rising consumption of bottled water, soft drinks, and ready-to-eat products is boosting PET resin production, while the growing apparel and home textile sectors are fueling polyester fiber demand. The market is also witnessing a shift towards sustainable practices, with higher adoption of recycled PET (rPET) and energy-efficient production technologies. Government initiatives supporting “Make in India” and domestic manufacturing of packaging materials further strengthen market expansion.

North America Polyethylene Terephthalate Market Trends

The North America polyethylene terephthalate market is expected to grow significantly over the forecast period, owing to an increasing focus on sustainability among consumers and businesses alike. In addition, the growing popularity of bottled beverages and ready-to-eat meals fuels the demand for efficient packaging solutions that maintain product quality. Furthermore, regulatory pressures encouraging recycling initiatives have led manufacturers to invest in technologies that enhance PET recyclability.

U.S. Polyethylene Terephthalate Market Trends

The U.S. polyethylene terephthalate market led the North American market and accounted for the largest revenue share in 2024, driven by the rising trend of health-conscious consumers seeking bottled water and natural juices. Furthermore, innovations in lightweighting technologies allow manufacturers to produce more efficient packaging while reducing material usage. This combination of factors positions the U.S. as a significant contributor to the overall growth of the polyethylene terephthalate market in North America.

Europe Polyethylene Terephthalate Market Trends

The polyethylene terephthalate market in Europe held a significant revenue share of 26.44% in 2024, primarily driven by stringent regulations to reduce plastic waste and promote recycling initiatives. The European Union's commitment to sustainability has led to increased consumer awareness regarding eco-friendly packaging solutions. in addition, the demand for recycled PET is on the rise, particularly in food and beverage packaging, as brands seek to enhance their sustainability profiles. Furthermore, technological advancements in recycling processes are improving the efficiency of PET reuse, further driving market growth.

Germany polyethylene terephthalate market dominated the European market and accounted for the largest revenue share in 2024 due to its strong manufacturing base and commitment to sustainability. In addition, the country’s rigorous environmental regulations encourage companies to adopt recyclable materials such as PET in their packaging solutions. With a robust beverage industry, Germany sees a high demand for lightweight and durable PET bottles that meet consumer preferences for convenience. Furthermore, innovations in production technologies enhance PET products' quality and performance, supporting their widespread adoption across various sectors.

Middle East & Africa: The Fastest-Growing Region in the PET Market

The Middle East & Africa (MEA) is emerging as the fastest-growing region in the market due to rising urbanization, population growth, and increasing disposable incomes, driving higher demand for bottled beverages and packaged foods. Expanding food and beverage, personal care, and textile sectors are further fueling PET consumption across the region. Investments in modern PET manufacturing facilities and advanced production technologies are enabling local industries to meet the growing demand efficiently. Additionally, the rising focus on sustainability and adoption of recycled PET (rPET) is supporting eco-friendly production practices.

The UAE Polyethylene Terephthalate (PET) Market Trends

The UAE market is witnessing steady growth driven by strong demand from the food and beverage, personal care, and packaging sectors. Increasing consumption of bottled water, soft drinks, and ready-to-eat products is fueling PET resin usage, while the region's growing retail and e-commerce sectors are boosting packaging requirements. The market is also influenced by sustainability initiatives, with rising adoption of recycled PET (rPET) and eco-friendly production practices. Investments in modern PET manufacturing and processing technologies are enhancing production efficiency and product quality.

Top Companies in the Polyethylene Terephthalate (PET) Market & Their Offerings

Tier 1:

- Indorama Ventures: Manufactures a wide range of virgin and recycled PET resins for bottles, packaging, and fibers globally.

- SABIC: Offers high-quality PET resins and is developing chemically upcycled PBT from ocean-bound PET waste.

- Alpek S.A.B. de C.V.: A leading producer of integrated polyester and recycled PET in the Americas, known for its single-pellet solutions combining virgin and recycled content.

- DAK Americas LLC: Produces a variety of branded PET container resins and is a major supplier of recycled "GreenPET" in North America.

- Reliance Industries Limited: A major integrated producer of polyester products in India, converting billions of post-consumer PET bottles annually into fibers.

- Far Eastern New Century Corporation: A vertically integrated producer and the world's second-largest supplier of recycled PET, known for pioneering bio-PET initiatives.

- China Resources Chemical Innovative Materials Holdings Limited: Specializes in producing non-fiber grade PET bottle flakes for beverage, oil, and medical packaging.

- Toray Industries Inc.: Focuses on high-performance, specialized biaxially oriented polyester (BOPET) films and advanced composite materials rather than standard bottle resins.

- Nan Ya Plastics Corporation: Offers a range of virgin and recycled PET resins used for both engineering plastics and food-grade packaging applications.

- Sinopec Yizheng Chemical Fibre Company: Leverages massive scale as a major subsidiary of Sinopec to produce a dominant market share of various PET resin grades and polyester fibers.

- JBF Industries Ltd.: Manufactures polyester chips, partially oriented yarn, and BOPET films with a global manufacturing presence.

- SK Chemicals: Concentrates on high-value, eco-friendly copolyesters and chemically recycled PET resins suitable for food contact applications.

More Insights in Towards Chemical and Materials:

- U.S. Polyolefin Compounds Market Volume to Reach 4.69 Million Tons by 2034

- Europe Recycled Plastics Market Size to Surpass USD 33.84 Bn by 2035

- Polyolefin Compounds Market Size to Reach USD 42.84 Billion by 2034

- U.S. Polyolefin Compounds Market Volume to Reach 4.69 Million Tons by 2034

- Polyolefin Market Volume to Reach 371.54 Million Tons by 2034

- Polyolefin Sheets in Industrial Market Size to Hit USD 14.99 Bn by 2034

- Recycled Polyolefin Market Size to Reach USD 144.2 Billion by 2034

- Polyethylene Terephthalate Catalyst Market Size to Hit USD 1,321.75 Mn by 2034

- U.S. Recycled Polyethylene Terephthalate Market Size to Reach USD 7.53 Bn by 2034

- Linear Low-Density Polyethylene (LLDPE) Market Size to Reach USD 118.69 Bn by 2034

- Polyethylene Terephthalate (PET) Market Size to Reach USD 68 Bn by 2034

- Polyethylene Glycol (PEG) Market Volume to Exceed 788,565.1 Tons by 2034

- Polyethylene Wax Market Size to Reach USD 3.56 Bn By 2034

- Mechanical & Chemical Recycling of Polyethylene Market Size, Share | CAGR of 10.29%

- Low-Density Polyethylene (LDPE) Market Size to Reach USD 80.34 Billion by 2034

- Polyethylene Market Volume to Hit 158.1 Million Tons by 2034

- Poly (Butylene Adipate-Co-Terephthalate) Market Size to Reach USD 4.42 Bn by 2034

- U.S. Recycled Polyester Market Size to Surpass USD 7.16 Bn by 2034

- https://www.towardschemandmaterials.com/insights/asia-pacific-recycled-plastics-market

- Recycled Engineering Plastics Market Size to Hit USD 7.89 Billion by 2034

- Recycled Plastic Pipes Market Size to Hit USD 20.08 Billion by 2034

- Recycled PET Flakes Market Size to Surge USD 36.06 Billion by 2034

- U.S. Recycled Plastics Market Size to Reach USD 131.33 Bn by 2034

- Recycled Plastics Market Size to Surpass USD 190.25 Billion by 2035

- Recycled PET (rPET) Market Size to Surge USD 29.19 Billion by 2034

- Recycled Polystyrene Market Size to Hit USD 7.49 Bn by 2034

- Recycled Plastics In Green Building Materials Market Size to Reach USD 12.24 Bn by 2034

- Recycled thermoplastics Market Size to Exceed USD 145.34 Bn by 2034

- Recycled Polyester Market Size to Hit USD 38.53 Bn by 2034

- Recycled Polyolefin Market Size to Reach USD 144.2 Billion by 2034

Polyethylene Terephthalate (PET) Market Top Key Companies:

- Indorama Ventures

- Far Eastern New Century

- DAK Americas

- Nan Ya Plastics Corporation

- SABIC

- Dupont

- Lotte Chemical Corporation

- LAVERGNE, Inc.

- Amcor plc

- Reliance Industries

- Octal Petrochemicals

- Jiangsu Sanfangxiang Group Co., Ltd.

- Eastman Chemical Company

Recent Developments

- In May 2025, detailed guidelines for the utilization of recycled polyethylene terephthalate (r-PET) as food contact materials (FCM-rPET) were issued by the Food Safety and Standards Authority of India (FSSAI). The guidelines were created to enable the safe incorporation of recycled PET in food and beverage packaging in the Ministry of Environment, Forest, and Climate Change.

- In May 2024, Pact Collective and Eastman announced the qualification of clean, multicolor polyethylene terephthalate (PET) waste as feedstock for Eastman’s methanolysis technology. This innovative process addresses the recycling challenges posed by multicolored PET, which is often unsuitable for mechanical recycling. The collaboration aims to convert this waste into high-quality copolyesters and PET for the beauty industry, promoting sustainability and reducing reliance on less eco-friendly disposal methods. This initiative represents a significant step toward a circular economy in beauty packaging

Polyethylene Terephthalate (PET) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Polyethylene Terephthalate (PET) Market

By Product Type

- Virgin PET

- Bottle-grade PET

- Film-grade PET

- Fiber-grade PET

- Recycled PET (rPET)

- Clear rPET

- Colored rPET

By Form

- Amorphous PET (APET)

- Crystalline PET (CPET)

- C-PET Trays

- Sheet & Films

- Granules/Resin

By Application

- Packaging

- Bottles

- Water

- Carbonated Soft Drinks

- Juices

- Alcoholic Beverages

- Others

- Jars & Containers

- Films & Sheets

- Textiles

- Fibers & Yarns

- Industrial Threads

- Electronics

- Insulation Films

- Semiconductor Encapsulation

- Automotive

- Under-the-hood parts

- Seat belts

- Others

- Construction

- Medical Devices

By End-Use Industry

- Food & Beverage

- Textile

- Automotive

- Electrical & Electronics

- Healthcare

- Consumer Goods

- Industrial

By Processing Technology

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

By Distribution Channel

- Direct Sales (OEMs)

- Distributors / Resellers

- Online Retail

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@https://www.towardschemandmaterials.com/checkout/5697

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/